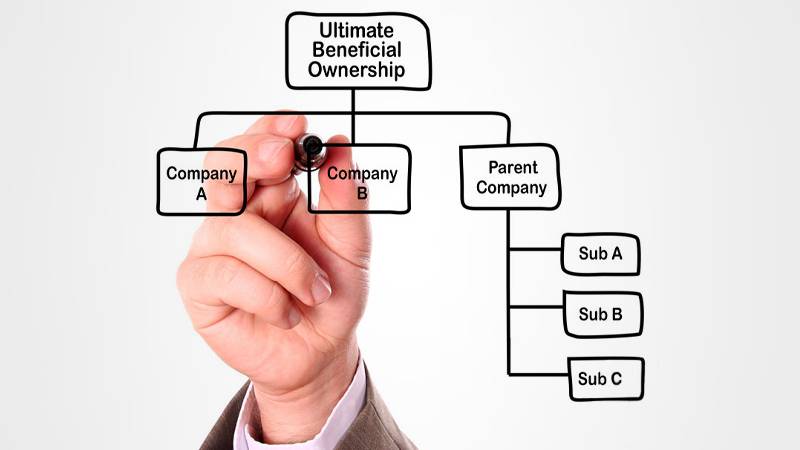

What is Beneficial Ownership?

Since when?

As of 1 April 2023, all Trusts are required to disclose their beneficial owners to the Master of the High Court (Master), and as of 24 May 2023, all Companies and Close Corporations must file the share register as well as the register of beneficial ownership, if applicable, via the online platforms of Companies and Intellectual Property Commission (CIPC).

Why?

These new beneficial ownership regulations align with global initiatives such as the Financial Action Task Force (FATF) recommendations and the G20 High-Level Principles on Beneficial Ownership Transparency. Compliance enhances South Africa's reputation in the international business community.

Who?

Directors of Companies, Members of Close Corporations, and Trustees of Trusts are required to provide information about the ultimate ownership or beneficiaries, including their names, addresses, and other identifying information.

Again, this is MANDATORY, and non-compliance may leave owners exposed to fines of up to R 10 million- or 5 years imprisonment, or both.

Please explain…

To understand what is expected, we need to refer to the Companies Act No. 71 of 2008 and the latest amended Regulations promulgated on 24 May 2024.

Definitions:

"affected company" means a regulated company as set out in section 117(1)(i) and a private company that is controlled by or a subsidiary of a regulated company as a result of any circumstances contemplated in section 2(2)(a) or 3(l)(a);

In short - a private company becomes a regulated company if, inter alia, more than 10% of the issued securities in the company have been transferred within 24 months “immediately before the date of an affected transaction or offer”; or if the Memorandum of Incorporation of that company expressly provides that its shares are subject to that part of the Act; or if the company is controlled by or is a subsidiary of a regulated company.

“beneficial interest”, when used in relation to a company’s securities, means the right or entitlement of a person, through ownership, agreement, relationship, or otherwise, alone or together with another person to-

- receive or participate in any distribution in respect of the company’s securities;

- exercise or cause to be exercised, in the ordinary course, any or all of the rights attaching to the company’s securities; or

- dispose or direct the disposition of the company’s securities, or any part of a distribution in respect of the securities…

In short – The Shareholder.

"beneficial owner", in respect of a company, means an individual who, directly or indirectly, ultimately owns that company or exercises effective control of that company…

In short – An individual/natural person/warm body who benefits via various means defined by the Act, such as being a shareholder, having voting rights, the ability to exercise control, etc.

When?

For existing entities, Information must be filed with CIPC at the same time as the filing of the Annual Duty or within 10 days after any changes to the shareholding or new registration.

Conclusion

In conclusion, the mandatory declaration of beneficial ownership for registered entities in South Africa is a significant development aimed at increasing transparency and accountability in the financial system.

Please contact us with any queries.

Want the legal references?

For the relevant definitions, sections, and regulations, please refer to the Companies Act no. 71 of 2008 and the Companies Amendment Regulations 2023 and General Laws Amendment Act, No 22 of 2022 via Government Regulation Gazette No. 11585.

Leave a comment

Quick Navigation

Lorette Terry

Mobile

+27 84 548 0739

Email